Vedanta Share Target Price : Hello friends, in today’s post we will analyze Vedanta Ltd company. We will try to know Vedanta share price target 2025, 2026, 2027, 2028, to 2030. In this article, we will do all the research of the company for you like what does the company do? How was the past performance of the company? Future status of the company? You will get to know all these research in this article.

Vedanta Company Overview

Vedanta Limited is a diversified natural resources company headquartered in India. It is involved in the production of zinc, lead, silver, aluminum, oil, gas, iron ore, copper, and power generation. The company is known for its sustainable mining practices and efforts to reduce poverty through employment opportunities.

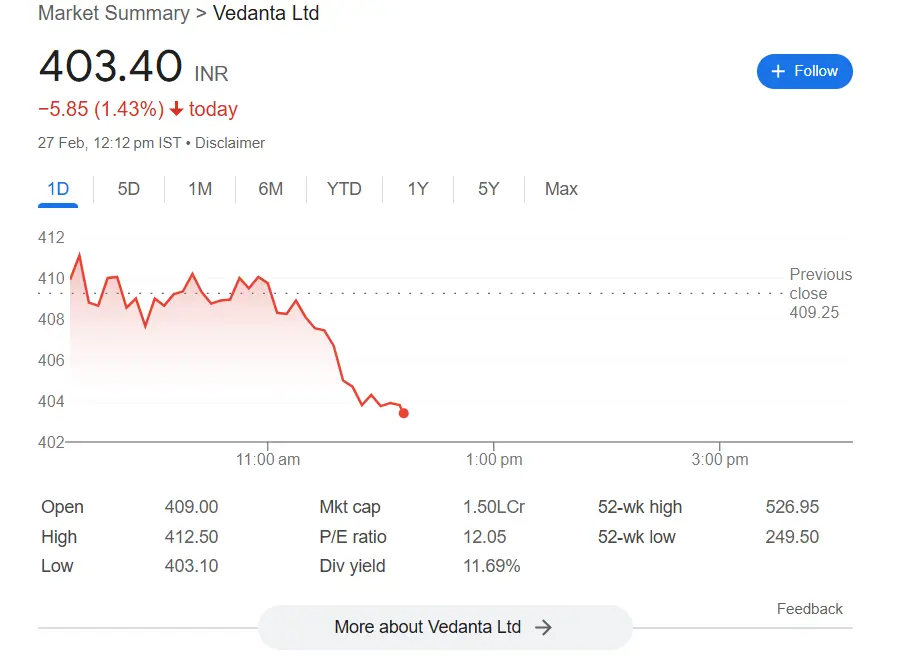

Vedanta Share Price Analysis

Current Market Data

- Market Cap: ₹1.50 LCr

- Open Price: ₹409.00

- High Price: ₹412.50

- Low Price: ₹403.10

- P/E Ratio: 15.05

- Dividend Yield: 11.69%

- 52-Week High: ₹526.95

- 52-Week Low: ₹249.50

Key Factors Affecting Vedanta Share Price

- Global Commodity Prices: The prices of zinc, aluminum, and oil directly impact Vedanta’s profits and share value.

- Sustainability Initiatives: Focus on sustainable mining and clean energy improves the company’s reputation and attracts investors.

- Regulatory Changes: Any changes in government policies in India or globally can influence the stock price.

- Economic Conditions: Inflation, global demand, and economic stability play a crucial role in Vedanta’s stock performance.

- Company Expansion: Increased production capacity and new projects contribute to growth and higher valuation.

Investor Holdings in Vedanta

- Promoters: 56.38%

- Retail & Others: 15.16%

- Foreign Institutions: 12.61%

- Other Domestic Institutions: 9.13%

- Mutual Funds: 6.72%

Vedanta Share Price Target (2025-2030)

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | ₹450 | ₹550 |

| 2026 | ₹550 | ₹650 |

| 2027 | ₹650 | ₹750 |

| 2028 | ₹750 | ₹900 |

| 2029 | ₹900 | ₹1000 |

| 2030 | ₹1000 | ₹1200 |

Vedanta Share Price Target 2025

- Expected Price Range: ₹450 – ₹550

- Reason: Expansion plans and stable global commodity prices could support this target.

Vedanta Share Price Target 2026

- Expected Price Range: ₹550 – ₹650

- Reason: Growth in production capacity and positive market conditions may drive the stock price higher.

Should You Invest in Vedanta for the Long Term?

Vedanta has a strong presence in the mining and energy sectors, making it a potential long-term investment. However, investors should consider market volatility, regulatory changes, and global economic conditions before investing. write simple bhasa

Conclusion

Vedanta’s stock price has the potential for significant growth in the coming years. Based on current trends, the share price target for 2025 to 2030 indicates a positive outlook. Investors should conduct their own research and consult financial experts before making investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do thorough research before investing.