Tata Power Share Price Target : Hello friends, in today’s post we will analyze Tata Power company. We will try to know Tata Power Share Price Target 2025, 2026, 2027, 2028, 2030, 2040 to 2050. In this article, we will do all the research of the company for you like what does the company do? How was the past performance of the company? Future status of the company? You will get to know all these research in this article.

About Tata Power Company

Founded in 1915, Tata Power is a part of the prestigious Tata Group. With its headquarters in Mumbai, Tata Power is one of the largest private sector companies in the Indian power sector. The company is involved in the generation, transmission, distribution, and trading of electricity.

Energy Portfolio

Tata Power is not limited to just traditional energy. Its portfolio includes:

- Thermal energy

- Hydroelectric power

- Solar power

- Wind energy

With a strong push toward clean and sustainable energy, Tata Power is aligning well with India’s renewable energy goals.

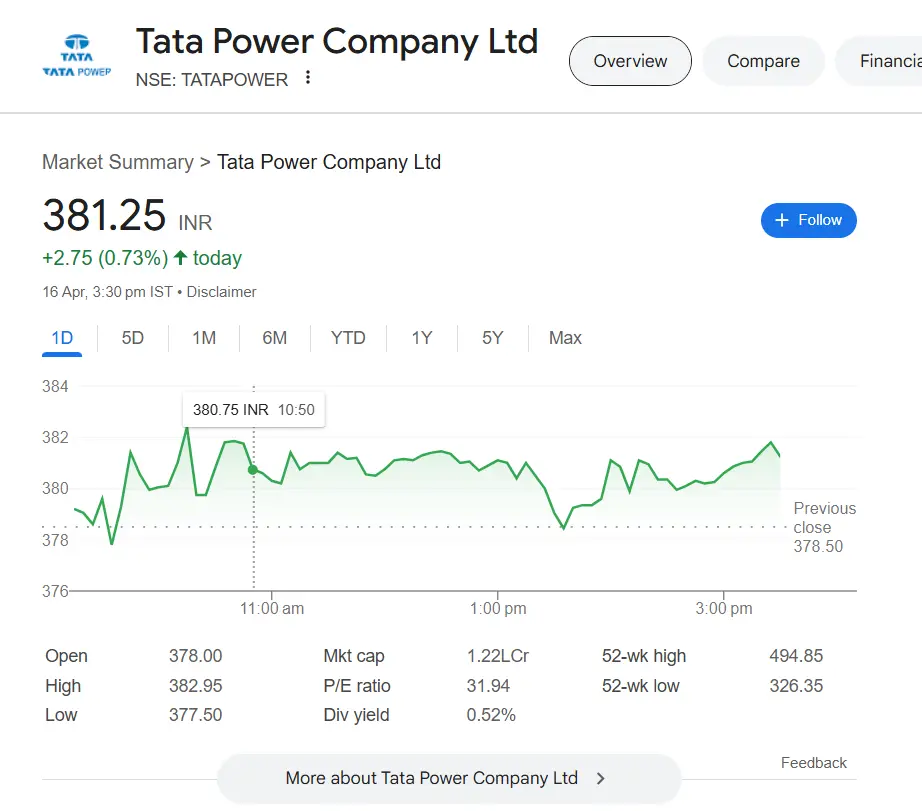

Tata Power Share Price Overview

As of 19th November 2024, the Tata Power share price is around ₹414.

| Attribute | Value |

|---|---|

| Market Cap | ₹1.22 Lakh Crore |

| P/E Ratio | 31.94 |

| Dividend Yield | 0.52% |

| 52-Week High | ₹494.85 |

| 52-Week Low | ₹326.35 |

| Book Value | ₹105.40 |

| Face Value | ₹1 |

Ownership Pattern

Here’s a look at the shareholding pattern of Tata Power:

- Promoters: 46.86%

- Retail & Others: 27.03%

- Foreign Institutional Investors (FIIs): 9.17%

- Mutual Funds: 9.13%

- Other Domestic Institutions: 7.82%

Tata Power Share Price Past Performance

Over the last 5 years, Tata Power has delivered remarkable returns:

- 638.75% return in 5 years

- 150.25% return in the past 1 year alone

These numbers clearly show strong investor confidence and consistent company growth.

Tata Power Share Price Target 2025, 2026, 2027, 2028, 2030 , 2040 and 2050

Based on current growth, renewable energy expansion, and market trends, here’s a projected share price target:

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | ₹400 | ₹600 |

| 2026 | ₹600 | ₹800 |

| 2027 | ₹800 | ₹1000 |

| 2028 | ₹1000 | ₹1100 |

| 2029 | ₹1100 | ₹1400 |

| 2030 | ₹1400 | ₹2000 |

| 2040 | ₹4000 | ₹6000 |

| 2030 | ₹8000 | ++ |

Tata Power Share Price Target 2025

Tata Power is gradually increasing its work in solar and EV charging stations. This effort may pay off in the coming one or two years. Therefore, by 2025, its share may reach Rs 400 to 600.

Tata Power Share Price Target 2026

When the company’s projects start running and people see the benefits, investors will also join in. This year we may see some more growth. Therefore, by 2026, its share price may reach Rs 600 to Rs 800.

Tata Power Share Price Target 2027

The era of EV will come, and Tata Power will be ahead in it. As people move away from petrol and diesel, the company will get more profit. Therefore, by 2027, its share can reach Rs 800 to 1000.

Tata Power Share Price Target 2028

By now, Tata Power would have built a good network of EV charging and solar systems across the country. This will increase both the company’s earnings and name. Therefore, by 2028, its share can reach Rs 1000 to 1100

Tata Power Share Price Target 2030

Green energy will be the dominant force in India by 2030, and Tata Power can be at the forefront of this race. If everything goes well, its share can reach Rs 1400 to 2000

Tata Power Share Price Target 2040

After 20 years, the company can become a big name – it can work not only in India but also abroad. This can be a great earning opportunity for long-term investors. Therefore, by 2040, its share can reach Rs 4000 to 6000.

Tata Power Share Price Target 2050

By 2050, the world will completely switch to green energy. If Tata Power continues to work hard, this stock can go above Rs 8000. Imagine how much profit one can make if one makes a small investment today and is patient.

Conclusion

Tata Power stands out as a stable and growth-oriented company. Its aggressive move toward renewable energy, strong brand reputation under Tata Group, and consistent past performance make it an appealing stock for long-term investment. If you are thinking about the future and sustainable returns, Tata Power could be a valuable addition to your portfolio.

Disclaimer

The information shared in this article is for educational and informational purposes only. Please do your own research or consult with a financial advisor before making any investment decisions. Share market investments are subject to risks.

Best Skills to Learn in 2025 : अगर आप 2025 में सफल होना चाहते हैं, तो इन स्किल्स में मास्टरी करें!