Sonata Software Share Price Target : Hello friends, how are you, in this article we are going to tell you how far Sonata Software Share Price Target 2025, 2026, 2027, 2028, 2029, 2030. Friends, our team has done research about this stock. Our team has analyzed the fundamentals of the company’s stock and tried to know how much return the company has given in the last 5 years. Friends, in this article we will do technical analysis along with the fundamentals of the company. We will know whether it will be right or wrong to invest in Adani Power. We will also know this, so friends, read this article carefully.

Overview of Sonata Software.

Sonata Software Limited is an Indian IT company started in 1986, based in Bengaluru, Karnataka. The company helps other businesses become more modern and digital.

They offer services like cloud planning, data management, digital customer support, and application improvement. They also use AI and machine learning to help companies make better decisions.

Their Lightning platform helps businesses try new projects using generative AI.

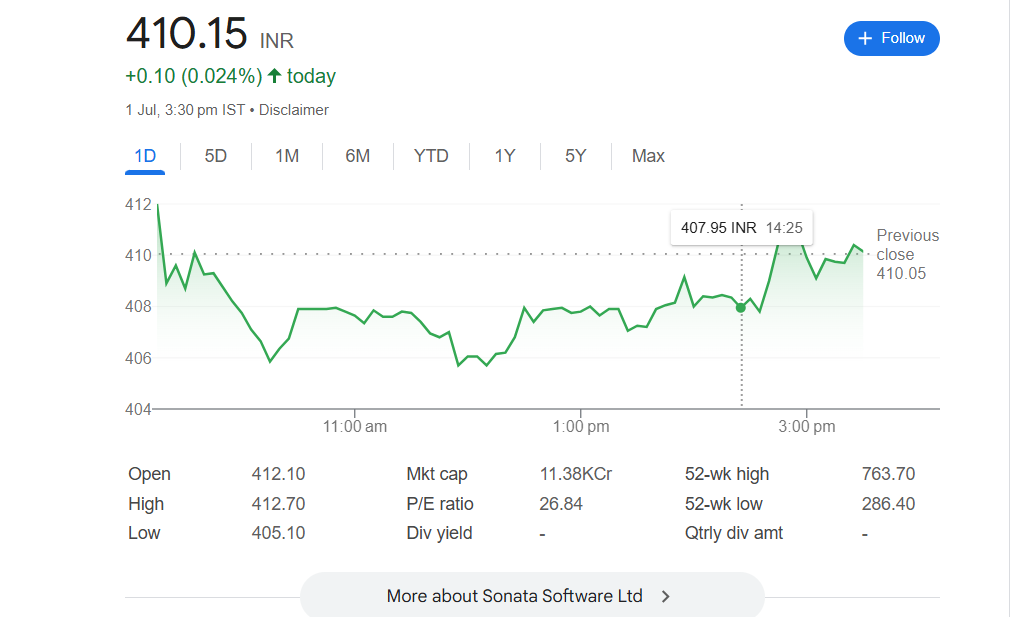

Sonata Software Market Performance

- Market Cap (Total Value): 11.38Kcr

- Current Share Price: ₹410.15

- Highest Price in 52 weeks: ₹763.70

- Lowest Price in 52 weeks: ₹286.40

- P/E Ratio: 26.84

- Dividend Yield: NA

- Book Value: 60.84

- Face Value : 1

- Promoter Holding: 28.17%

Performance of Sonata Software in Past Years

Sonata Software has shown a mixed performance over the past few years. If we look at the last 5 years, the stock has given an impressive return of around 357.63%, which shows strong long-term growth. However, in the last 1 year, the stock has seen a decline of about -31.07%, mainly due to market corrections and short-term challenges in the IT sector. Still, if we consider its all-time performance, Sonata Software has delivered massive gains of over 1250.29%, proving its strength as a solid long-term investment. These numbers highlight that while short-term ups and downs are common, the company has performed well over the long run.

Sonata Software price Target 2025, 2026, 2027 , 2030 , 2040 , 2050

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | ₹400 | ₹450 |

| 2026 | ₹450 | ₹600 |

| 2027 | ₹600 | ₹750 |

| 2028 | ₹800 | ₹1000 |

| 2029 | ₹1000 | ₹1300 |

| 2030 | ₹1300 | ₹2,000 |

| 2040 | ₹2000 | ₹3,000 |

| 2030 | ₹3000 | ₹5,000+ |

Note: These targets are based on market trends, current financials, and future business potential. Actual prices may differ due to market risks.

Why Sonata Software Can Grow?

- Strong Digital Demand: More businesses are moving to cloud, AI, and digital tools. Sonata is already in this space.

- Global Clients: It works with big international clients, giving it stable income.

- Tech Innovation: Its Lightning platform helps businesses adopt generative AI, which is a big future trend.

- Smart Acquisitions: The company keeps expanding by buying other tech firms.

- Healthy Financials: Profitable company with consistent revenue growth.

Risk Factors

- Global recession or slowdown in IT spending may affect income.

- High competition from bigger IT companies like TCS, Infosys, Wipro.

- Currency fluctuations (USD-INR) can impact profits.

Conclusion

Sonata Software is a strong mid-cap IT stock with good future potential. If you’re a long-term investor looking to invest in the digital and AI space, Sonata can be a smart choice. However, always do your own research or consult a financial advisor before investing.

Disclaimer:

This article is for educational purposes only. Share market investments are subject to market risks. Do proper research before investing.