RVNL Share Price Target : Do you want to know how much RVNL’s share price can rise from 2025 to 2030? If yes, then read this article carefully. We have conducted an in-depth analysis of the company, including its past 5-year returns, fundamentals, and future potential. Let’s find out whether investing in RVNL stock would be a good decision or not.

Overview of Rail Vikas Nigam Ltd (RVNL)

Rail Vikas Nigam Ltd (RVNL) is a government-owned enterprise established in 2003. The primary purpose of RVNL is to develop and modernize railway infrastructure in India. The company focuses on electrification, laying new railway lines, doubling existing lines, and managing various railway projects.

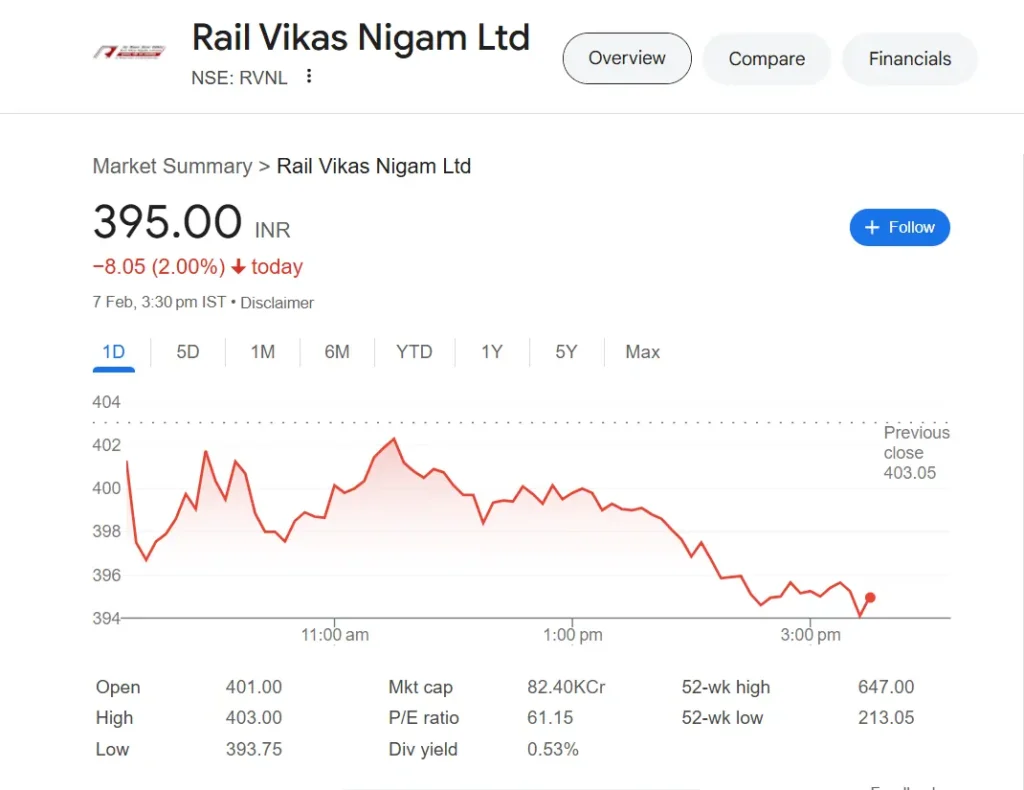

Current Performance of RVNL Shares

- Market Cap: ₹87,700 Cr

- Current Share Price: ₹420.20

- 52-Week High: ₹647.00

- 52-Week Low: ₹162.10

- P/E Ratio: 65.37

- Dividend Yield: 0.50%

- Book Value: ₹42.17

Investor Shareholding in RVNL

- Promoters: 72.84%

- Retail Investors & Others: 15.79%

- Foreign Institutional Investors: 5.05%

- Other Domestic Institutions: 6.12%

- Mutual Funds: 0.21%

Investor Shareholding in RVNL

RVNL Share Price Target from 2025 to 2030

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 450 | 550 |

| 2026 | 550 | 750 |

| 2027 | 750 | 850 |

| 2028 | 850 | 950 |

| 2029 | 950 | 1150 |

| 2030 | 1150 | 1300 |

RVNL Share Price Target 2025

RVNL is focusing on railway electrification and modernization, which is expected to yield good results. In the past 5 years, the stock has delivered a 1650.83% return, which is highly impressive. Based on its growth trajectory, the stock is expected to trade between ₹450 and ₹550 in 2025.

RVNL Share Price Target 2026

With the expansion of metro projects and increased private sector participation in railways, RVNL is expected to see further growth. Additionally, it offers good dividends to investors. Analysts predict the share price to be ₹550 to ₹750 by 2026.

RVNL Share Price Target 2027

As railway infrastructure projects expand, RVNL’s stock is likely to gain more traction. The projected share price for 2027 is ₹750 to ₹850.

RVNL Share Price Target 2028

With digitization in railways and the introduction of high-speed trains, RVNL could experience further growth. The stock price may reach ₹850 to ₹950 in 2028.

RVNL Share Price Target 2029

If the government continues investing in railway projects, RVNL could see strong growth, with a projected stock price of ₹950 to ₹1150 by 2029.

RVNL Share Price Target 2030

By 2030, RVNL will likely play a significant role in railway infrastructure development, and experts predict the stock price to be between ₹1150 and ₹1300.

RVNL’s Balance Sheet and Future Prospects

RVNL has a strong balance sheet, benefiting from government support and increasing railway investments. Given the rising demand for infrastructure development, the company is well-positioned for long-term growth.

Is Investing in RVNL a Good Decision?

If you are a long-term investor looking for steady returns, RVNL could be a good choice. However, stock market investments always carry risks. It is advisable to conduct thorough research and consult a financial advisor before making any investment decisions.

Conclusion

In this article, we analyzed RVNL’s share price targets from 2025 to 2030. With strong fundamentals, government backing, and continued railway modernization, the stock has great growth potential. However, investors should always do their research before making investment decisions.

Disclaimer:

This article is for informational and educational purposes only. Stock market investments are subject to risks. Investors are advised to consult financial experts before making investment decisions.